What is included in an estate?

It includes all of your property, such as:

- Real estate (for example, your home or an investment property)

- Personal property (such as cars, furniture, antiques, coins or art)

- Intangible property (which includes bank and investment accounts, stocks and bonds, Social Security benefits, life insurance policies and loans you made to other people)

Types of Asset Ownership:

- Jointly owned

- Right of survivorship – surviving owner receives immediately

- Tenants in common – your share of assets goes to your heirs

- Named beneficiary – for example, life insurance policy

- Solely owned – owned solely by you

Elements of Estate Planning

- Power of attorney – another person can act on your behalf

- Living will – advance medical directive regarding health care

- Will – specifies how assets are to be distributed on death

- Trusts – legal arrangements to hold assets and property

Types of wills

- Simple – specifies distribution of assets

- Testamentary-trust – establishes a trust to receive assets

- Pour-over – puts estate in trust before death

- Holographic – handwritten, not witnessed

- Oral – not written

- Joint – one document with two wills (for example, husband and wife)

Types of trusts

- Testamentary – activated after death

- Bypass – funded up to “lifetime exemption”

- Marital power of appointment – assets put in trust for spouse

- QTIP – qualified terminable interest property, benefits spouse of second marriage and children of first marriage

- Living – all assets placed in trust while person is alive

Advantages of trusts

- Reduce or eliminate estate taxes

- Avoid probate

- All assets under one plan

- Can be changed

- Quicker distribution of assets

Disadvantages of trusts

- Transfer all assets

- Keep transactions separate

- Cost

- State law

- Conflicts

Estate Planning Checklist

- Identify your assets

- Decide how assets will be distributed and to whom

- Consider having a power of attorney prepared

- Complete a living will

- Prepare a will

- Update your beneficiaries on life insurance, benefit plans

- Learn about and consider a trust

- Learn about estate taxes

- Consider retaining an attorney to prepare key documents

- Enjoy the peace of mind of a completed estate plan!

For more information: Web Resources

- estateplanning.com

- nolo.com (enter “estate planning” in search box)

- elderlawanswers.com (enter “estate planning” in search box)

- A Guide to Living Trusts, www.legalzoom.com

- Understanding Trusts, www.usa.gov

- Estate Planning, American Bar Association, http:// tinyurl.com/estate1

Software

- Quicken Willmaker Plus: www.nolo.com (enter “Quicken” or “Willmaker” in search box)

Books

- Plan Your Estate, Denis Clifford

- Kiplinger’s Estate Planning: The Complete Guide to Wills, Trusts, and Maximizing Your Legacy, John Ventura

- 60-Minute Estate Planner: Fast and easy plans for saving taxes, avoiding probate, and maximizing inheritance, Sandy Kraemer

This material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL)

A registered investment advisor and broker-dealer (member FINRA / SIPC).

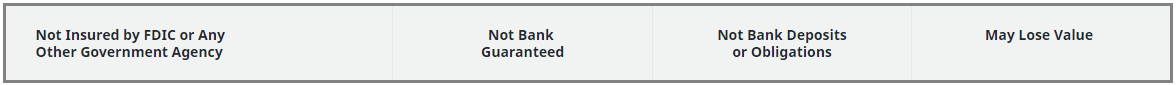

Insurance products are offered through LPL or its licensed affiliates. Anderson Brothers Bank and Anderson Brothers Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Anderson Brothers Investment Services, and may also be employees of Anderson Brothers Bank. These products and services are being offered through LPL or its affiliates, which are separates entities from, and not affiliates of, Anderson Brothers Bank or Anderson Brothers Investment Services. Securities and insurance offered through LPL or its affiliates are:

Anderson Brothers Bank (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for brokerage or advisory services.

Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

LPL Financial Representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial. Member FINRA/SIPC. RP-545-0420 Tracking #1-876054 (Exp. 4/22)

Source SKU: LPL-RP-545